Solaria Corebit is a website that connects its users to investment education firms. Sailing through investment waters without substantial knowledge may be ill-advised. Solaria Corebit presents a solution by connecting interested individuals with suitable investment education firms.

The website was created in response to the fact that educational resources surrounding investments are vast and may be hard to decipher. Solaria Corebit aids its users by bringing them close to investment education firms that unravel the nuances of investing.

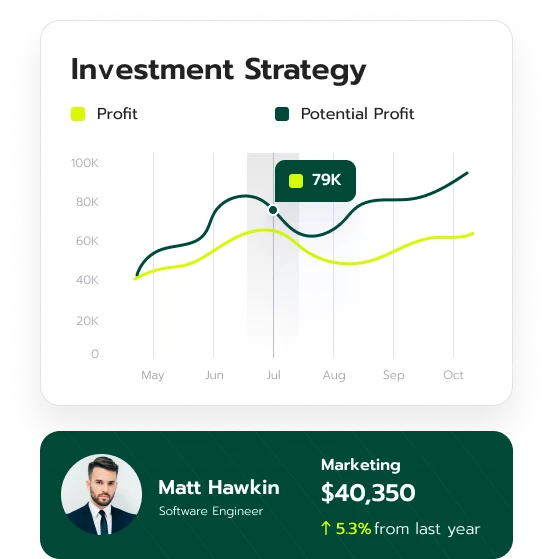

For ease, Solaria Corebit registration has been simplified. The requested information is easily obtainable, and the registration can be completed within minutes. The connection can not get simpler than that. Intrigued? Read more to know how to get registered on Solaria Corebit.

Intending learners are to register on Solaria Corebit, and this is a quick process. By filling in the required personal information on the Solaria Corebit website and clicking register, one is only a few steps away from starting their investment education.

After successful registration, new users on Solaria Corebit are relayed to a suitable investment education firm. These firms are equipped to manage the new users and train them to develop the skills they need for the investment world.

Interested in learning about investments? Get started with Solaria Corebit. Read on to understand the full details of the package.

Following registration and connecting the new user, all that remains is contact from the investment education firm. Solaria Corebit connects users to these suitable firms, and when these firms reach out, they get to know the user.

The educational curriculum is the sole responsibility of the investment education firm. The firm would direct a representative to contact the user and acquaint them with the educational process.

There is no registration fee or hidden charge when registering with Solaria Corebit. It is free. To connect with an investment education firm, interested individuals should register on Solaria Corebit.

Using the website has been made super easy. Solaria Corebit cares about its users, and this can be seen in the website design.

Solaria Corebit makes it simple for people across the world to connect with investment education firms because there is no language barrier. Solaria Corebit ensures ease of interaction with its website, allowing diversity in registration.

Market indicators are tools that can be used to analyze the financial market, and this helps investors gain clarity as to where the market could sway. Market indicators are quantitative, and these tools seek to interpret market psychology and financial data. They aid decision-making and are often composed of formulas or ratios. Learn more via Solaria Corebit.

There are hundreds of market indicators currently being used today. Some of the popular types used include On-Balance Volume, Moving Averages, Market Breadth, and Market Sentiment. Learn more about its distinctions through Solaria Corebit.

Market indicators and technical indicators are not far apart. Their application (both Market and Technical) all aim to improve informed decision-making. Market indicators are similar to technical indicators because they both apply statistical data through formulas and ratios to forecast and, therefore, indicate possible market movements.

The major contrast between the two would be that market indicators use data from several securities, unlike technical indicators. Intrigued? Learn more via Solaria Corebit.

Technical indicators fly over a range of mathematical patterns that form across the market, and these patterns are analyzed to help forecast the market. Based on that, these mathematical data employ historical data to understand price trends and inform trading decisions. Interested in learning more about technical indicators? Sign up for free on Solaria Corebit.

As stated earlier, there are several choices when it comes to one’s pick of market indicators, depending on one’s purpose. The choice of indicator matter and suitable application may set traders apart. A few types of market indicators include:

Market Breadth

Investors target Market Breadth compares data of several securities showing similar movement in price action.

Market Sentiment

Market Sentiment indicators aim to differentiate between the price of a stock or security and the volume of the trade. This indicator seeks to inform traders if the overall sentiment in the market is bullish or bearish.

Moving Averages

Moving averages help even out available price data. They help eliminate unnecessary price data and simultaneously simplify key data across time periods. It is often expressed as a single line.

Market indicators may be indispensable tools to traders, giving them a clear read on market behavior. Get registered with Solaria Corebit to connect with firms that offer more clarity on market indicators.

The On-Balance Volume (OBV) is a vital market indicator that gathers data relating to volume into one flowing line. They are confirmatory indicators because they do not predict, but rather, they confirm trends. A rising OBV would indicate an increase in price and vice versa. Gain more insight into OBV through Solaria Corebit.

The term ‘Liquidity’ may pose several questions to the uninformed. In basic terms, liquidity is the rate of ease at which an asset can be converted into capital without affecting its market price.

The ability of the market to make that conversion (asset to capital) and to what extent would determine how the market can move. Therefore, the more liquid an asset is, the easier it is for it to convert back into capital.

An alternative outlook on liquidity can be that it describes the degree to which a security or asset can be quickly bought or sold in the market at a price tantamount to its underlying value. Learn more through Solaria Corebit.

There are a couple of concepts used when discussing liquidity. These are the snippets that may offer more insights into the full scope of liquidity. Interested? Learn more via Solaria Corebit.

Education firms offer more in-depth knowledge of liquidity and provide clarity. Solaria Corebit connects its users to these firms to get started. Get registered on Solaria Corebit to know more about liquidity.

This is an extra compensation used to promote investments in assets that may be time-consuming or difficult to convert to capital at a fair market value.

Asset liquidity simply shows how easy it is to convert an asset into capital. The most liquid asset is capital itself, while other assets, like collectibles, are much less liquid.

It is the risk that an asset can not be traded quickly enough or converted to capital without affecting the market price.

A liquidity trap is a severe economic occurrence that happens when people keep and hold capital instead of investing or using it, even with low interest rates.

Herd mentality is a concept in behavioral finance, an inescapable aspect of the art. Finance is embedded in statistics, maths, and human participation. This often leads to bias due to human emotions, which can sometimes cloud sound judgment. Solaria Corebit links individuals to firms that can educate them on this behavioral concept.

As the name suggests, herd mentality is the tendency to follow and copy what others are doing in terms of finance, trading, or investments. Rather than following one's analysis, herd mentality tempts individuals to follow the crowd. This is largely influenced by emotions and instincts. Registering on Solaria Corebit would link interested individuals with the education required to spot herd mentality.

Non-conformity can be scary, and it triggers fear in people. This is because when a group of people says they are following a certain path, say X, and no one is taking path Y, individuals unsure of what path to take may face embarrassment or appear unsound if they choose path Y (especially if it turns out to be a wrong choice). How does one break free from herd mentality bias? Learn more by connecting through Solaria Corebit.

Herd mentality can cause market instability, increase market volatility, cause quick price surges, dramatic crashes, asset overvaluation, and lots more. Investments driven by herd mentality often lack sustainability and foundation. Eager to know more? Get registered on Solaria Corebit.

There is substantial evidence of herd mentality in the financial market, and this is because of emotion and sentiment. Human beings are hard-wired to herd, and it may be psychologically triggering or emotionally painful to stray from the herd, but keeping such thinking at bay is essential for investors. Suitable education firms available through Solaria Corebit train individuals to make decisions objectively rather than bandwagoning.

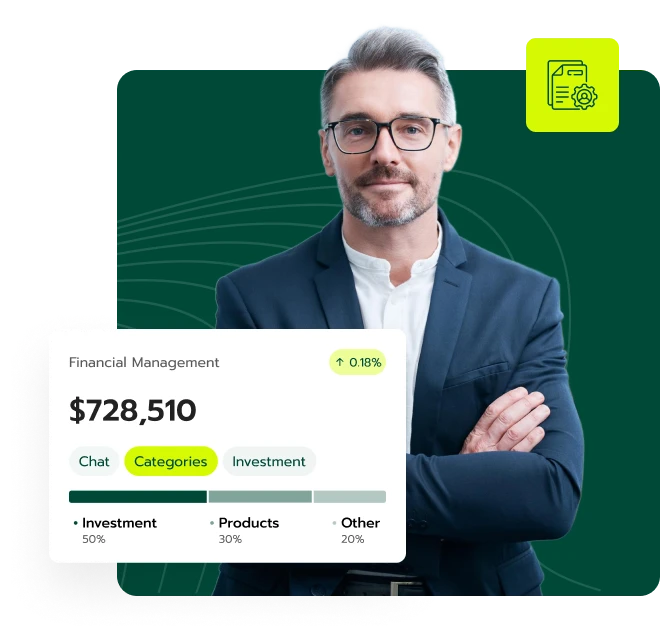

Solaria Corebit works hand-in-hand with investment education firms to provide an avenue for individuals to reach out and gain the knowledge they seek. Solaria Corebit connects these individuals to the firms that may have the resources they seek to make sense of the world of investments. Once equipped to handle investments, individuals may go on to apply that knowledge. Interested? Get registered on Solaria Corebit for free.

Loss aversion in finance is when traders are so afraid of losing they begin to focus more on avoiding losing than seeking actual gains. This can happen when an individual experiences more and more losses over time. The more they lose, the more likely they become prone to loss aversion.

This is the inclination to focus majorly on an initial reference point. For example, prolonged focus on the initial price of an asset when making a decision. This can stem from a combination of cognitive biases or emotions and sometimes the difficulty of the decision to be made.

As the name suggests, this is an error that forces individuals to overestimate their knowledge and/or ability in the financial market, opening them up to mistakes and poor decisions.

Regret aversion involves avoiding decision-making with the fear of potential regrets, thereby hindering one’s chances and causing missed opportunities.

This cognitive bias causes individuals to overestimate or overvalue the assets in their possession over other assets.

This trait causes one to overestimate their ability to forecast market events. This could be because they believed previous market events were predictable, creating a false sense of ability to forecast.

Human emotions are no doubt a characteristic of finance and investments, and with them, there is the potential to make errors. Nevertheless, developing the skills and mindset to navigate investments with confidence and technique requires education. Investment education firms equip individuals to make data-driven financial decisions, and Solaria Corebit is the bridge that connects the two. Register for free on Solaria Corebit to learn from suitable investment tutors.

| 🤖 Cost to Join | Sign up at no cost |

| 💰 Service Fees | Absolutely no charges |

| 📋 Enrollment Process | Quick and easy sign-up process |

| 📊 Learning Areas | Training on Crypto, FX Trading, Equity Funds, and More |

| 🌎 Regions Served | Serviceable in almost all nations but not in the USA |